The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation. Currently, 16 states (Alaska, Arizona, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, New Jersey, New York, Oregon, South Dakota, Vermont, and Washington) and the District of Columbia have passed bills or approved ballot measures that allow for the sale of recreational marijuana, and more states are poised to pass legislation this session. In total, actual recreational marijuana sales are happening in 11 states.

The Virginia legislature now has passed a bill that would legalize sales starting in 2024; legislators are currently working with Gov. Ralph Northam (D) to amend and finalize legislation. New Mexico lawmakers are very likely to pass legislation during an ongoing special session.

Voters in four states approved ballot measures in November, but only one state (Arizona) has established an operational marketplace. Vermont, which passed legalization back in 2018, has finally approved legislation, and the state plans to be operational starting in 2022. Recreational sales are delayed due to pending legal action in South Dakota and federal prohibition in the District of Columbia, although change is on the horizon in DC.

The unique legal framework under which marijuana use and sales operate—that of differing state and federal legality—means that every state market is essentially a siloed market. Marijuana products cannot cross state borders, so the entire process (seed to smoke, so to speak) must occur within state borders. This unusual situation, along with the novelty of legalization, has resulted in a wide variety of tax designs.

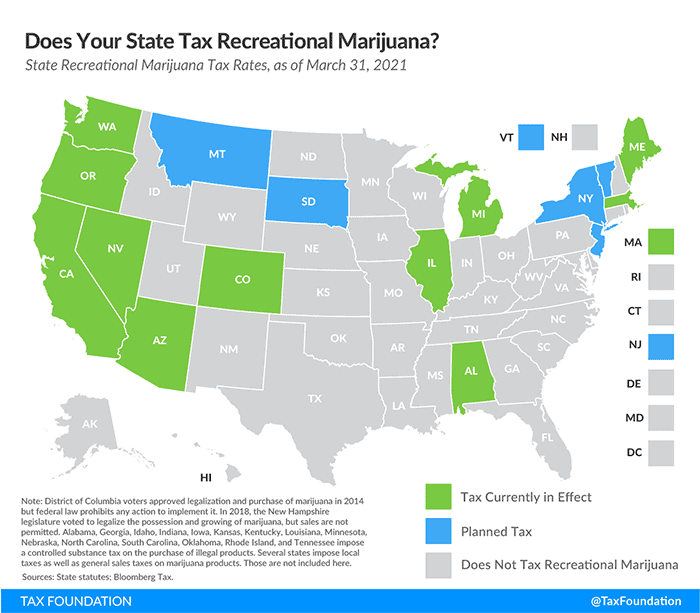

The following map highlights the states that have legal markets and levy taxes on recreational marijuana.

The multitude of approaches makes any apples-to-apples comparison of rates difficult, but Washington state has the highest statewide retail-level excise tax, at 37 percent. New York, the most recent addition, is the first state to implement a potency-based tax by milligrams of THC.

As the table indicates, most states have applied a price-based (ad valorem) tax on retail sales of recreational marijuana. Levying the tax on retail sales allows for simplicity because there is a taxable event with a transaction, allowing for simple valuation. Although ad valorem taxation is simple, it is neither neutral nor equitable. In order to tax marijuana efficiently, the tax should be levied at a rate that corresponds to the societal costs, called externalities, associated with the product. These externalities share no association with the price.

A profitable new industry to tax is understandably enticing to many lawmakers, but an excise tax on recreational marijuana should be based on the following principles:

- Tax rates should be low enough to allow legal markets to undercut, or at least gain price parity with, the illicit market;

- Taxes should be designed to offer stable revenue in the short term regardless of potential price declines; and

- Taxes should raise enough revenue to fund marijuana-related spending priorities and cover the societal cost related to consumption.

A tax system following these principles would be based on weight or potency, have relatively low rates, and allocate revenue to offset societal costs associated with recreational marijuana consumption.

Of the states that have passed legislation, all but Alaska, Colorado, Maine, Montana, and Oregon levy the general sales tax on marijuana sales in addition to excise taxes. Alaska, Montana, and Oregon do not levy a statewide general sales tax in the first place, and Maine and Colorado levy retail-level excise taxes in lieu of, and with higher rates, than their general rates.

One of the great challenges with tax design for recreational marijuana is the amount of product types available on the market. Today, consumers can purchase THC-containing products in many different shapes and forms. Anything from traditional pre-rolled joints and brownies to THC-containing sparkling water and the yet unknown products to come. Any tax system should either be nimble enough or updated frequently enough to capture new products as they enter the market.

There are still many unknowns when it comes to the taxation of recreational marijuana, but as more states open legal marketplaces and more research is done to understand the externalities of consumption, more data will be available.

For more discussion on the trade-offs of marijuana tax structures and general excise tax design, see the Tax Foundation’s recent report.

This article was originally published by the Tax Foundation. It is reproduced here with permission.