As cannabis legalization becomes more widespread across the U.S., farmers are discovering new ways to grow the crop.

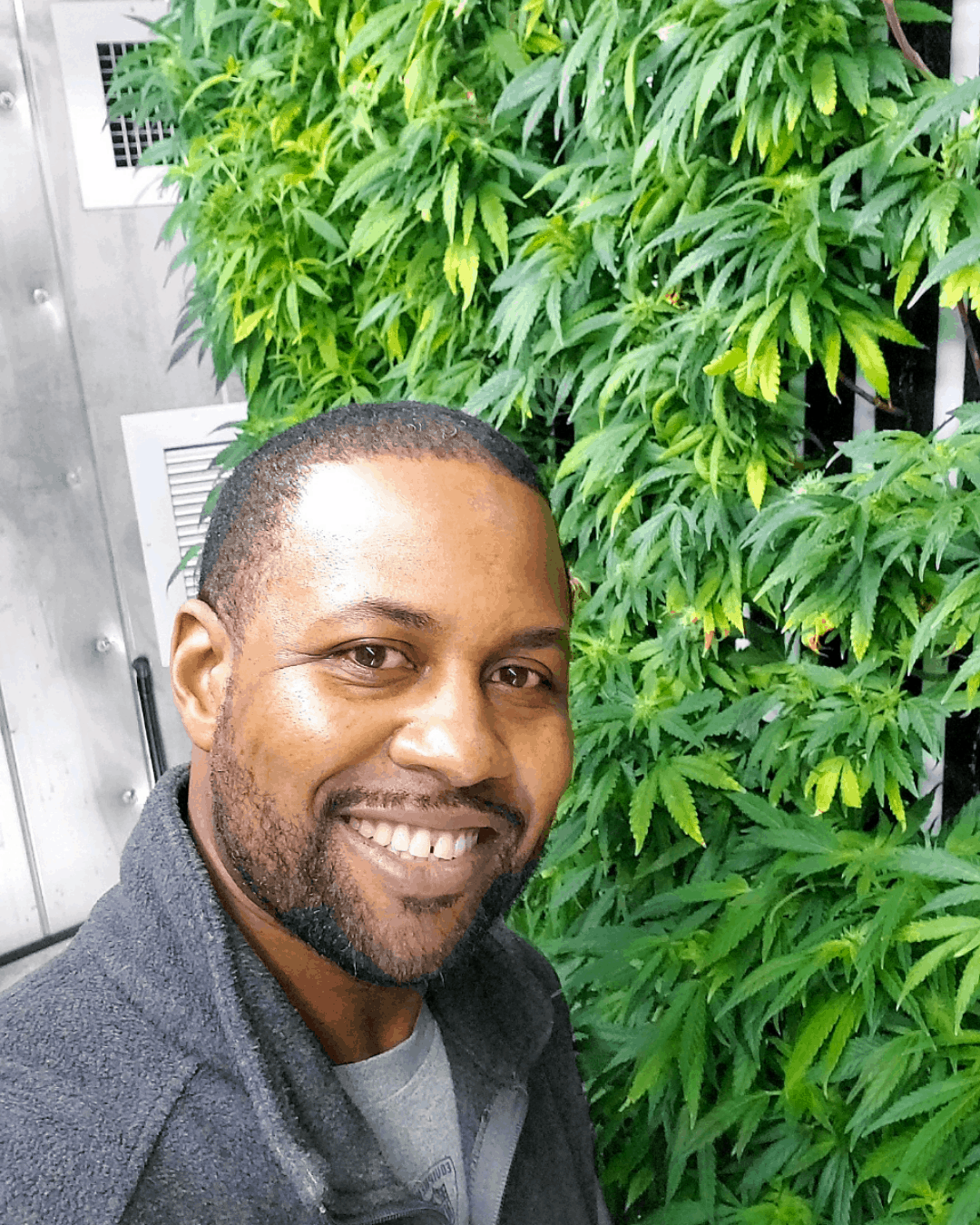

DeMario Vitalis, owner of New Age Provisions Farms, a farming business based in Indianapolis, has experience growing a variety of crops outdoors, but a couple years ago, he began searching for something new—a method that might provide him more control over his work.

In 2019, Vitalis started to explore cultivating hemp indoors hydroponically—the process of growing plants in soilless nutrient solution, Cannabis Business Times previously reported.

That year, Vitalis began working with Freight Farms, a Boston-based company that provides farmers with cultivation software integrated within a 320-square-foot shipping container. He received his first shipping container from the company in August 2020 and his second one in January.

Through the use of automation equipment, the Greenery S and farmhand, Freight Farms has created a way for growers to control and access their farming operations from anywhere in the world.

According to James Woolward, chief marketing officer at Freight Farms, the Greenery S manages the environment inside the 40-foot shipping containers using four specialized systems: air, light, water and nutrient control. It also has sensors throughout the grow area so it can relay information, data and updates about the grow directly to farmhand, an operating system app that growers can download on their phone.

Freight Farms works with farmers who grow several different crops hydroponically inside shipping containers, including lettuces, leafy greens, herbs, flowers, roots and more, but the company recently started incorporating cannabis and hemp.

“We have three or four [growers] at the moment that grow cannabis and hemp,” Woolward says. “They’re independent customers, so they buy the farm from us, and then they build their own business. We have quite a lot of customers [who use this as] an addition to their traditional agriculture because you’re removing seasonality, basically.”

The Benefits

One of the most significant benefits of growing hydroponic cannabis and hemp in a shipping container is that growers do not have to worry about the outdoor climate, Woolward says. Instead, they can harvest year-round, even in areas that reach extremely hot or cold temperatures.

“We have a lot of customers in Alaska and Canada, and you can imagine during the winter, the [shipping containers] become more of an engine of their business because it gives [them] that control 365 days a year,” he says.

© Courtesy of New Age Provisions Farms

Despite Vitalis’ experience with outdoor cultivation, he says he prefers growing in the shipping container. It has given Vitalis better control over his crops—something he felt he needed, as he can manage his crops even when he’s not in the vicinity. The Freight Farms environmental control system allows him to see what’s happening within and around his hemp crops.

“It reminds me if levels are getting too low or too high to check the app and set alerts,” he says. “If I leave the farm, I’m able to get into the app, turn the lights on and make sure the fans and pumps are running. And as that stuff is going, it also measures the environment in the farm. It measures the temperature, humidity, CO2 [carbon dioxide] levels, pH levels and EC [electrical conductivity] levels. So, all of that is at the palm of your hand, and you can also control and set those levels as well, according to what you’re growing.”

Additionally, Woolward says the harvest time in a shipping container compared to growing outdoors can be shorter (depending on the variety) because of the intensity of nutrients going straight into the plants, combined with the LED lights, which growers can use to replicate natural light but at a higher strength, he says.

Challenges

Vitalis says one of the biggest learning curves from transitioning from growing outdoors to growing to growing hydroponically indoors was learning the correct dosing of nutrients for his crops.

As Robert Eddy, a consultant and former Purdue University greenhouse manager, previously wrote for Cannabis Business Times, when growing hydroponically, the “nutrient solutions are automatically fed into irrigation lines using a fertilizer injector drawing from concentrated fertilizer tanks or pumps drawing from reservoirs of pre-mixed solutions.”

“When you grow outdoors, the nutrients are provided with the soil, but in a shipping container, you have to supplement the nutrients and the dosing tanks,” Vitalis says. “In [hydroponic cultivation], the nutrients that the hemp plants need are also absorbed by other plants, such as your herbs and your lettuces. So, you just have to do trial and error and see what the hemp likes and what the other lettuces like. [Freight Farms] also gives you a supplemental tank to put extra nutrients in as well.”

Ensuring the tanks inside the shipping container are filled with water was another challenge Vitalis faced when transiting to hydroponic farming. If the tanks aren’t filled, it effects the nutrients as well.

“When growing hydroponically, you’re totally reliant on water,” he says. “One of the things I had to learn was to make sure the tanks are filled, the pumps are running, and that there’s water flowing because the machine will tell you that the pump is on and that it’s running, but it won’t tell you that there’s water flowing through the pumps.”

He suggests growers pursuing hydroponic cultivation to check the water flow frequently to ensure their plants remain healthy, he says.

Opportunities

Growers can purchase a farm from Freight Farms for roughly $140,000, and operating costs could range from $25,000-$30,000 a year depending on wages like electricity, water and annual supplies, Woolward says.

Woolward suggests growers have a good understanding of their local zoning, regulations and customer base before cultivating in a shipping container.

“The key to our successful customers is their good business people that go and find the market and understand their market and the best way to service that market to get the occurring revenue,” Woolward says.

Vitalis also suggests that growers weigh the pros and cons of growing hydroponically versus growing traditional depending on their area.

“Sometimes there may be more benefits to doing a traditional type of farming than it is to grow hydroponically,” Vitalis says. “For example, if you have access to a bunch of land, it may make sense for you to grow traditional farming. You just want to make sure your numbers are right before you jump in.”