Trulieve Cannabis Corp., the largest fully licensed medical cannabis company in Florida, announced May 10 its definitive arrangement agreement for the acquisition of Arizona-based Harvest Health and Recreation Inc., in a $2.1-billion deal.

Primarily a vertically integrated “seed-to-sale” company, Trulieve touted the all-stock transaction as one that creates the most profitable multistate operator in the U.S. Harvest Health and Recreation, a multistate operator in its own right, has a retail and wholesale footprint that recorded continued growth over the past decade.

The handshake was not surprising as far as merger-and-acquisition activity in the cannabis space, which has been hot and heavy since the November 2020 election, but the whopping price tag attached to the deal was a head-turner, said Jonathan Havens, a partner at Saul, Ewing, Arnstein and Lehr’s Philadelphia-based law firm. He counsels clients on transactional matters in the cannabis industry.

“This is a big deal. The price tag is obviously quite notable,” Havens said. “But look, the M&A, the deal activity in the cannabis space, has been hot for a while and I think will continue to be hot. The price tag here is big. Trulieve is a very strong operator with a strong balance sheet, which gives them the opportunity to go out and make acquisitions like this.”

RELATED: M&A Uptick Expected to Continue in 2021

The Trulieve-Harvest deal shows that the cannabis industry is maturing and pursuing more targeted, strategic acquisitions rather than the land grab of early 2019, said Sander C. Zagzebski, a member at Clark Hill, a multidisciplinary, international law firm. Based in California, Zagzebski represents clients in mergers, acquisitions, dispositions and other change-of-control transactions.

“This is the latest, and largest, in a series of significant recent deals, starting with Curaleaf’s acquisition of Grassroots and followed by Verano’s deal with AltMed, Ayr’s acquisition of Liberty Health, Columbia Care’s deal with Green Leaf, and BRND’s deal with Glass House,” Zagzebski said. “These deals, along with Cresco’s $1-billion shelf registration and GTI’s recent debt announcement, show a renewed bullishness on the part of leading cannabis companies to go for the win after playing defense since late 2019.”

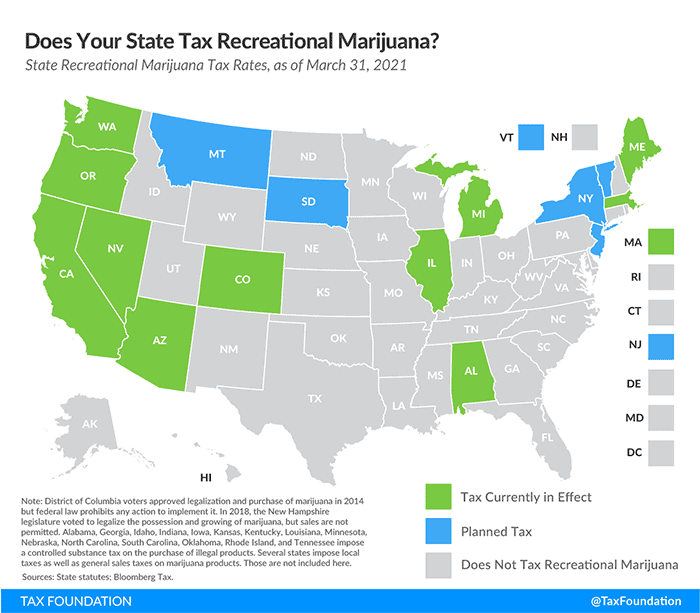

Recent M&A enthusiasm is not only buoyed by the November 2020 elections, but also by the excitement around New York’s legalization, the recently announced legislation in Texas and other states, and the hope that the Secure and Fair Enforcement (SAFE) Banking Act may finally be signed into law, Zagzebski said.

As operators like Harvest get stronger and amass more licenses under their belts for a bigger footprint, they’re going to become attractive to potential acquirers, Havens said.

“And that’s what you saw here,” he said. “Harvest is obviously a big operation, as is Trulieve. Combined, it’s going to be quite a big player in the space.”

Minutes before Trulieve announced the acquisition, Harvest reported its first-quarter 2021 financial results, highlighting $88.8 million in revenue—up 101% from $44.2 million in the first quarter of 2020. The first-quarter revenue results also represent a 27% increase compared to $69.9 million in the fourth quarter of 2020.

As of March 31, Harvest owned, operated or managed 37 retail locations in six states. Meanwhile, Trulieve is a licensed operator in Florida, California, Massachusetts, Connecticut, Pennsylvania and West Virginia.

Upon completion of the Trulieve-Harvest transaction, as well as the closing of other previously announced acquisitions by Harvest and Trulieve, the combined business will have operations in 11 states, comprising 22 cultivation and processing facilities with a total capacity of 3.1 million square feet, and 126 dispensaries serving both the medical and adult-use cannabis markets, according to Trulieve.

“What’s interesting about the cannabis space is, because of the regulatory requirements, you’re going to continue to see mergers and acquisitions between companies that are in different footprints,” Havens said. “You’re obviously not going to acquire someone that’s in the same footprint you are because there’s limited licenses and you can’t have too many licenses in most jurisdictions. So, you’re going to find a dance partner, a merger partner, who fills the gaps you have in your business, in regions or whole sections of the country where you don’t have licenses.”

The acquisition will not only expand Trulieve’s presence in the Northeast and Southeast but also establish a Southwest hub. On Jan. 22, Harvest recorded the first adult-use cannabis sale in the state of Arizona at its Scottsdale location—Arizona was one of four states where voters passed adult-use cannabis measures in November—and began serving adult-use customers, in addition to medical patients, at all 15 of its Arizona dispensaries that same day.

“Harvest provides us with an immediate and significant presence in new and established markets and accelerates our entry into the adult-use space in Arizona,” Trulieve CEO Kim Rivers said. “Trulieve and Harvest are leaders in our markets, recognized for our innovation, brands and operational expertise with true depth and scale in our businesses. We look forward to providing best-in-class service to patients and customers on a broader national scale as we create an iconic U.S. cannabis brand.”

Based in Florida, Trulieve cultivates and produces all of its products in-house and distributes those products to Trulieve-branded dispensaries throughout the state, as well as directly to patients via home delivery, according to the company.

Under the terms of the acquisition arrangement agreement, shareholders of Harvest will receive 0.117 of a subordinate voting share of Trulieve for each Harvest subordinate voting share (or equivalent) held, representing total consideration of approximately $2.1 billion based on the closing price of the Trulieve shares on May 7.

“We are thrilled to be joining Trulieve, a company that has achieved unrivaled success and scale in its home state of Florida,” Harvest CEO Steve White said in a statement. “As one of the oldest multistate operators, we believe our track record of identifying and developing attractive market opportunities combined with our recent successful launch of adult-use sales in Arizona will add tremendous value to the combined organization as it continues to expand and grow in the coming years.”

With cannabis stocks up significantly from their March 2020 lows, it is safe to expect continued consolidation for the next several quarters, Zagzebski said.