Editor’s Note: There is no denying that the cannabis industry is rapidly growing and evolving, leaving many in the industry to have to continuously adapt to the ever-changing landscape. I interviewed three professionals with a well-built background in cannabis, who share their experiences, lessons learned, insights and tips on working in the cannabis industry.

Tips from Crystal Oliver, executive director for the Washington Sungrowers Industry Association (WSIA) and co-founder and former owner of Washington’s Finest Cannabis. Oliver shares her personal experiences and lessons learned as a small business owner in the cannabis industry with Cannabis Business Times.

RELATED: 6 Cannabis Business Lessons We Learned Too Late

I wish I knew..

1. The value of hiring a professional lobbyist compared to the price you pay for bad policy.

The saying, “If you’re not at the table, you’re on the menu,” comes to mind when I reflect on the evolution of cannabis policy in Washington. Early on, other farmers and I focused on community organizing and advocating for ourselves. What we lacked in experience, we made up for in passion, but this did not always translate to policy wins. We often knew why a policy proposal would hurt our businesses but getting legislators and regulators to listen to us and modify their approach was incredibly challenging.

Washington’s independent cannabis farmers suffered through several legislative sessions, where bills passed damaged our business prospects before the WISA held its first Sun Cup competition/fundraiser in 2018 and hired contract lobbyist Bryan McConaughy. The difference in having a professional, experienced lobbyist made our ability to block bad bills from becoming law and favorably amend other bills cannot be overstated.

Had I fully understood how impactful being represented by a professional would be, I would have done whatever it took to fund a lobbyist immediately. I would have considered it a cost of doing business rather than a nice-to-have. As an emerging industry, the winners and losers are often decided in government agency meeting rooms and state capitals. You must be effectively represented in those spaces if you want to secure your future.

2. The challenges of living without access to affordable and traditional financing.

When I first started my farm, I knew I could not access small business startup funding from my bank. So, I chose to use my savings and income from my corporate day job. I later left my day job to focus on cannabis farming full-time, not realizing that relying solely on cannabis-related income would render me ineligible to secure any loan from a traditional funding source. It was a little shocking when I discovered that my credit union would not issue me a loan to purchase a new vehicle despite having good credit, low debt and sufficient income. As a result, I have had to save and pay cash for vehicles purchased since becoming a cannabis farmer. In hindsight, I should have worked harder to maintain a non-cannabis-related income stream.

3. The reluctance of policymakers to address inequities in the marketplace.

For example, allowing direct farm sales would better distribute the industry’s economic benefits throughout the supply chain by empowering small independent craft producers. Still, policymakers hesitate to distribute power away from those who already hold it. On more than one occasion, I have been advised that I need to get buy-in from those who benefit from the existing inequities in the marketplace to secure policy reform.

It is impossible to reach those who benefit most from an unfair system to agree to changes that would help others. In Washington, we have been fighting for direct farm sales for several years now https://www.cannabisbusinesstimes.com/article/washington-cannabis-growers-direct-sales-customers/> without much progress due to our legislators’ fear of disrupting the status quo. I naively believed that legislators would place greater value on fairness and thought we would secure farm-direct sales after a few years. I remain hopeful that direct farm emphasis on equity for BIPOC communities may lead to reassessments of our marketplaces’ overall structure, which centermost of the market power in the hands of a few well-capitalized interests.

Courtesy of Crystal Oliver

4. The difficulties of owning and operating a small business when your children are not permitted to step foot on the premises.

I was pregnant when I planted my first state-legal cannabis plant in 2014, and my daughter was born one month before our first state-legal harvest. When we decided to have a child shortly after applying for licensure, I envisioned tending my cannabis field with my baby in a sling or back carrier like the other organic farmers I knew. I understood that farming would be hard work and knew that working where I lived with my family in rural Washington would be a dream come true. Unfortunately, the rules surrounding marijuana cultivation in Washington prohibited individuals under 21 from setting foot on the licensed premises. My children were not allowed to enter the building or the fenced-in area of our property, where our cannabis business was located. Over the years, this created many challenges for our family. My husband and I had to alternate who was working so that one of us could supervise the children, causing long days for us both. Our children grew to resent our business because it took up so much of our time and separated us from them.

It was not until the COVID-19 pandemic shut down schools that we could convince the Washington Liquor and Cannabis Board (WSLCB) to grant leniency and allow children and grandchildren of licensees under 16 to be in the licensed premises, as they did not engage in any work. It has been a blessing for farmers to have their children allowed on site, but it is a painful reminder of the time we have missed out on over the last six-plus years. I regret not considering how impactful it would be not to bring my children to work with me as a small business owner.

Tips from David Holmes, founder and CEO of Clade9. Holmes entered the cannabis industry nearly 20 years ago, back when cannabis was just starting to become medically legal in a few states. His self-starter and self-educating attitude helped guide him; however, he tells Cannabis Business Times that there are a few things he wishes he would have done differently before entering the ever-changing cannabis industry.

I wish I knew…

1. The advantage of having an education in business.

I am a trained mathematician, as I have a master’s degree in math, but I never took traditional business courses. Others have mentored in business and learned things, but I kind of had to learn everything on my own. I wish I had more support; that would have been super powerful. Especially having been in cannabis in the late ’90s, I have never really had a huge advantage having both skill sets; learning how to grow cannabis and have business training.

I had to learn over the years, and I have picked up a lot. The first time I had to formally negotiate a contract to cannabis entrepreneurs to negotiate a business deal was when I thought, “I wish I were trained formally in business.” I think everyone learns by doing it but having said that, having formal training or maybe just being in another business industry would have been very valuable.

Courtesy of David Holmes

2. The value of having a background in agriculture as a cultivator.

Being a cultivator, I wish I would have gone to school. I am glad I got a degree in math, there is no question about it, but I also wish I would have studied agriculture, precisely controlled environment agriculture, as my focus is cultivation breeding. It took me many years to learn controlled environment agriculture in Canada, without any formal training, so I self-taught.

For example, I did not understand all the variables that I needed to look at to grow consistent crop quality, like thinking to myself, “Oh, shoot, next time I should look at humidity, I wasn’t looking at that the first time.” A lot of failures led to light bulbs going off, saying, “Hey, I need to know more about that because that’s what hurt me last time.” Doing that for over 15 to 20 years, you learn a lot, but if I had formal training, I would have thought of those things all together right away instead of learning over time.

3. The benefit of entering the industry with a different mindset.

I wish I would have known cannabis was going to be an industry because when I got into it, it really was not an industry. If I had known it would be where it is, I would have approached it a lot differently. It was medical in California, but it was a total gray area, and it stayed that way until 2017 or 2018. Most cannabis entrepreneurs in California have been in the industry for a lot longer than other states, especially on the east coast. In a lot of their minds, they are probably thinking, “I wish I would’ve known this was going to be this big of a deal nearly ten years ago.”

Tips from Loren Picard, CEO of High Desert Flower Inc. in Oregon. Picard started as a financial and corporate operational consultant in the cannabis industry nearly four years ago. Within a couple of months, he was asked to be his client firm’s CEO. He shares what he is learned throughout his last four years in the industry with Cannabis Business Times.

RELATED: 6 More Lessons We Learned From Our Cannabis Business

I wish I knew…

1. How underprepared states were for cannabis legalization.

I have been around a little over four years in the industry, starting in late 2016, with other states having legalized before and since, and I did not have a long runway to get up to speed. It takes a year or so after each state legalizes to implement its enabling regulations. That seems to be plenty of time for states to learn from other states’ successes and failures and should lead to some semblance of consistency across state jurisdictions. Unfortunately, the result has been a patchwork of rules and regulations within and between the states resulting in most states woefully underprepared when their respective licensing processes began. We had an operation in California, which we sold, and then grew a vertically integrated operation in Oregon, and how the two states’ regulators looked at the cannabis world was completely different.

Courtesy of Loren Picard

2. The difference between the economics of capped and un-capped states.

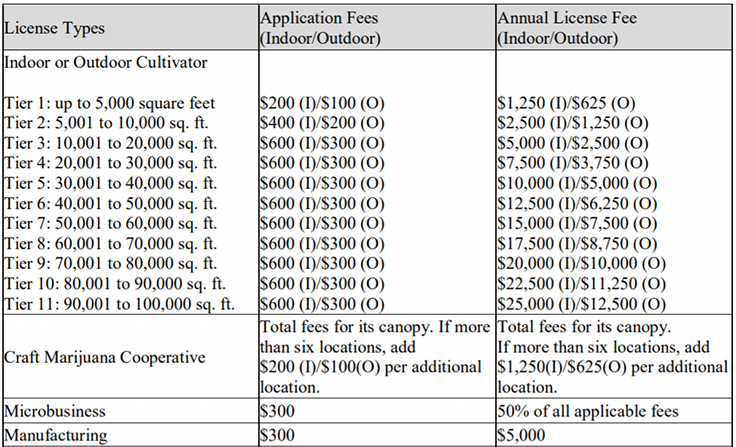

Oregon started as an uncapped state, but in June 2018 they just stopped taking applications, and it suddenly became a capped state. In hindsight, I should have thought about the whole idea of licensing as a way a firm could build value before June 2018. You could have created a lot of value by getting control of one small location (leased or purchased) and applying for multiple licenses and just put the licenses into operation when it made sense; some may not have been put into operation at that location. You would then have the flexibility to move the licenses to an optimum location with or without bringing in partners.

Obviously, there are nuances to this strategy that need to be thought through to make it worthwhile, but it was a viable long-term strategy. That would be a strategy I would do today in an uncapped state if the license costs are reasonable. If they are a hundred thousand apiece, no, but if they are a couple of grand, it could be worth it. Even if a state never caps their license issuances, there are only so many good qualified real estate locations in any state for a cannabis business. Eventually, licenses will be capped by a lack of suitable sites.

3. How little economic taxing authorities understand.

The whole idea that you cannot put up to 50% combined tax rates, including at the local level, on top of cannabis retail prices and expect to make any movement on shrinking the [illicit] market, I think, was a mistake. I think there should have been a long ramp-up of minimal taxes to pay the regulatory and enforcement agency’s overhead on top of the already collected application and license issuance fees; then start ramping up over time as the black market shrank in size.