Updated: 11:13 a.m. Eastern Standard Time, Dec. 5

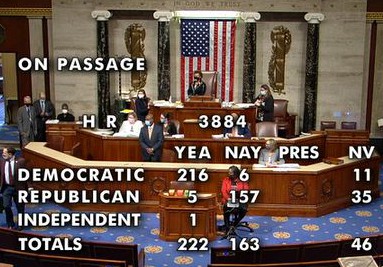

The U.S. House of Representatives has passed the Marijuana Opportunity Reinvestment and Expungement (MORE) Act, H.R. 3884, to remove cannabis from the U.S. Controlled Substances Act. It passed 228-164.

“We applaud the House of Representatives for passing meaningful legislation aimed at ending the federal prohibition on cannabis,” David Culver, vice president of U.S. government & stakeholder relations for Canopy Growth Corporation, told Cannabis Business Times and Cannabis Dispensary. “The MORE Act, which effectively legalizes cannabis nationwide, will help spark a post-COVID economic recovery by creating millions of new jobs, and billions in new tax revenue annually when America needs it most.”

“A body of the U.S. Congress voting to legalize cannabis for the first time is an historic event that will be celebrated by long-time advocates, criminal justice reform proponents, patients, veterans, and the millions of Americans who continue to express their support for legalization at the ballot box,” added Patrick Martin, principal and director of the Midwest arm of Cozen O’Connor Public Strategies in Chicago.

Screenshot of vote tallies as the vote was called Dec. 4

The bill will now go to the U.S. Senate, where Congress members expect it will not pass.

However, Charlie Bachtell, CEO and co-founder of multi-state cannabis operator Cresco Labs, said the symbolic significance of this bill passing the U.S. House is important to celebrate.

“I’m big on the incremental nature of how change occurs in this industry with this subject matter. You know, even if … this doesn’t get heard or let alone pass in the Senate, the fact that you have your second bill that’s cannabis related get approved by the House is fundamentally important. It is the incremental nature of change on cannabis. This is how it looks, this is how it happens,” Bachtell said. “We are witnessing cannabis kind of cross the barrier into not only good policy, but good politics. People get elected on platforms that are supported by being a more progressive view on cannabis. It’s great to see. It’s great to be a part of.”

Victoria Mendicino, chief of staff to the CEO at Revolution Global, an Illinois-based vertically integrated cannabis company, said company leaders see the vote “as the latest signal of increasing momentum around federal cannabis legalization and reform. MORE is the farthest reaching cannabis reform bill to ever pass and ever be voted on by a whole chamber of Congress, so it really stands apart.”

Culver noted that the MORE Act could have fresh support from the incoming Biden administration, as Vice President-Elect Kamala Harris is an original sponsor of the Senate version of the bill.

“We urge the Senate to recognize that cannabis legalization is on the march—supported by a vast majority of Americans—and pass this legislation immediately,” Culver said. “It’s time to unlock the economic and social equity benefits of cannabis, and end this outdated prohibition that has disproportionately punished minority communities for far too long.”

Cannabis’ removal from the U.S.’ list of controlled substances, said U.S. Rep. Sheila Jackson Lee (D-Texas) in a Dec. 2 Rules Committee hearing, “means that going forward, individuals could no longer be prosecuted federally for marijuana offenses. This does not mean that marijuana would now be legal in the entire United States—a very important point. It will simply remove the federal government from the business of prosecuting marijuana cases and will leave the question of legality to the individual states.” Jackson Lee is an original cosponsor of the act.

RELATED: UPDATE: UN Votes to Remove Cannabis From List of Most Dangerous Drugs

The tension between federal and state cannabis policies has long created issues for businesses operating within state-legal cannabis programs.

“The primary concern has been simple illegality—with cannabis on Schedule I, we’ve been operating businesses, on the adult-use side, that are subject to interference from federal law enforcement,” said Nick Etten, VP of governmental affairs for multi-state cannabis operator Acreage Holdings. “Because of federal illegality, there is no interstate commerce, which is how all other industries in this country function.”

“Any widget in commerce would be allowed to be sold outside of state lines if the demand was there, [but] obviously that’s not the case with the current overarching federal regime,” added Dan Pabon, general counsel and chief government affairs officer with Schwazze, and a former Colorado House representative. “I think the [federal-state] tension is most palpable when you look at the business side of the industry, which in turn, of course, affects the patients and the consumers. It makes the products more expensive, it makes them less available. It makes patients potentially seek out relief in the black market. These are all of the things that no one wants, especially in the kind of pandemic situation that we’re in. It’s certainly something that needs to be straightened out as soon as possible. And I think that’s what the vote in Congress is trying to do.”

Legislation like the MORE Act could also help change the minds of private investors and larger corporate entities that have been hesitant to get involved in the U.S. cannabis industry due to federal prohibition, Etten said.

“Many more traditional entities have sat on the sidelines because of federal illegality issues, and are closely watching these votes as well as opportunity with a new administration,” he said.

“Between decriminalization and the election results not only in White House but all around the country, [these latest moves] signal that cannabis reform, whether it’s the medical or recreational level, is on its way,” Pabon added. “And just like anything else, capital follows a potential new trend or seizes an opportunity. Capital will follow.”

Kim Stuck, CEO of Allay Consulting, agreed that the biggest impact of the MORE Act on licensed cannabis businesses would be financial.

“Nothing really will change for them except that the federal government can’t impose any rules on states and make them follow,” she said. “They’re pretty much saying, ‘Hey, we’re going to leave it up to the states for what they want to do. We’re not going to go in and make any issues against you for having legal cannabis or anything like that.’ … It’ll definitely bring investors in from other places. It doesn’t make it legal, but it’s not completely illegal. I think that people will be a little more [willing to be involved].”

In addition to descheduling and decriminalizing cannabis, the MORE Act creates a “Criminal Justice Office,” which will, among other things, create a grant program to provide job training and reentry services; and provide legal aid, including for the “expungement of cannabis convictions.”

“Importantly, the MORE Act would legalize cannabis with a focus on social justice and equity—an important step in righting many of the wrongs caused by the decades-long failed War on Drugs,” Culver said.

The act places a 5% federal tax on the sale of cannabis products; that tax will then increase by 1% each year and cap at 8%, according to Congress members who spoke during the Dec. 4 full-floor U.S. House debate.

It also directs the Small Business Administration to create a “Cannabis Opportunity Program” that would “assist small business concerns owned and controlled by socially and economically disadvantaged individuals.”

“The damage of cannabis prohibition has left a broad multi-issue path of destruction including justice, incarceration, employment, healthcare and income inequities,” said Hilary Black, Canopy Growth’s chief advocacy officer. “Prohibition of cannabis—the war on drugs—is a war on people, a war on families. Today I am hopeful we are seeing the beginning of the end of that war. … This is about human rights, about social justice, and access to healthcare.”

The MORE Act would not change all federal laws regarding cannabis, however, according to Stuck.

“The FDA, for example, they still are seeing this as a drug that needs to be approved to be put in product,” she said. “They’re there and they’re going to recognize it when they want to. And they’re going to write regulations when they want to. So, this certainly doesn’t make it federally legal or federally regulated either. It just opens that gate and allows states to do what they want without any federal issues.”

Harris originally introduced the MORE Act in the Senate, and Jerrold Nadler (D-N.Y.) introduced the bill in the House.

In the Dec. 4 House debate on the MORE Act, original cosponsor Barbara Lee (D-CA) expressed her support for it.

“I tell you—we have got to, colleagues—we have got to give our young people a second chance, so please vote yes on this bill to help us move our unfinished business of liberty and justice for all forward,” Lee said. She noted racial disparities and mass incarceration that are present in the U.S.’ criminal justice system.

Matt Gaetz (R-Fla.) is the only Republican in the U.S. House or Senate to cosponsor the MORE Act, according to Congress.gov.

RELATED: How U.S. House, Senate Results Could Influence Cannabis Legislation

The Dec. 4 vote was bipartisan, with five Republicans and one Independent, Justin Amash (D-Mich.), voting in favor of the act. Six Democrats voted against it.

Gaetz said in the Dec. 4 hearing that Congress members who oppose the act are not aligned with the opinions of a majority of Americans.

“I’m going to vote for the MORE Act,” Gaetz said during the hearing. “It won’t pass the Senate. It won’t become law. But then we should come back in the 117th Congress, and we should truly do more for our people.”

David Mangone, director of policy and government affairs for The Liaison Group, echoes this sentiment.

“For industry, the MORE Act paves the way for cannabis reform that seeks to develop a more diverse industry, create access to banking, the potential of capital markets and the elimination of 280E,” he said. “Industry should cheer this vote and be ready to get to work in the 117th Congress on other ‘components of progress,’ including taxation structures, importation paradigms and ensuring that any legislation that ultimately becomes law will protect the communities that the MORE Act seeks to protect.”

According to Jonathan Havens, co-chair of the Cannabis Law Practice at Saul Ewing Arnstein & Lehr, major policy reform will not happen overnight, and even if the bill doesn’t come up for a vote in the Senate, the House’s passage of the legislation lays the groundwork for future change.

“If the House votes to pass the MORE Act, that is one of the two chambers of Congress saying, ‘We approve the legalization of cannabis,’ and our country’s policy toward cannabis has been the same for decades—that would be a significant step forward,” Havens said. “Of course, it would be a lot more helpful if the Senate agreed, took it up, voted on it, and the president signed it into law because that would mean that cannabis is no longer federally illegal.”

Numerous opponents of the MORE Act expressed concerns in the Dec. 4 hearing, as well as in the Dec. 2 House Rules Committee hearing, that Congress should not prioritize cannabis legalization over a new COVID-19 relief package. Supporters of the bill have indicated that the two initiatives are not mutually exclusive.

The Minority Cannabis Business Administration (MCBA) stated in a press release that it supports the bill but opposes specific provisions.

“Although Minority Cannabis Business Association (MCBA) supports and applauds the social equity provisions including the expungement of records and the establishment of an Opportunity Trust Fund and the Cannabis Justice Office, we have grave concerns over the provisions in this bill that we believe would have an immediate chilling effect on individual members in our community and minority business owners more broadly,” stated the release.

Amber Littlejohn, executive director of MCBA, told Cannabis Business Times and Cannabis Dispensary after the vote that she and other members of the organization have been working with Congress members such as Lee and Earl Blumenauer (D-Ore.), another original sponsor, to strengthen economic-justice messaging in the bill.

“We will continue to work with them to ensure that next time we introduce the vote on and pass in any chamber of Congress–federal cannabis legislation–that it will include economic justice and the voices of minority cannabis operators,” Littlejohn said.

During the Dec. 2 Rules Committee hearing, Blumenauer said: “I think it’s safe to say that I’ve been working on this issue longer than any other politician in America. I started in 1973 when Oregon was the first state to decriminalize. I’ve been campaigning on this literally from Bangor, Maine, to Santa Barbara, California, working with a number of you on these provisions. I’m excited that we’ve reached this point, and I think it’s an opportunity for the federal government to be a full partner that the states deserve.”

Ed Perlmutter (D-Colo.), original sponsor, expressed concern about the Senate’s likelihood to pass the MORE Act. “Hopefully we can get the Senate to get off their duff and take something up,” Perlmutter said. “I mean, they are scared of their shadows on this thing, or at least their leadership is, because there is bipartisan support for advancing our marijuana laws in the Senate if their leadership would ever take anything up, which is pretty frustrating, because America is so far ahead of this Congress on this subject, it’s ridiculous.”

A recent U.S. House amendment changed the MORE Act. Alterations include limiting cannabis expungement to people who have been charged with nonviolent federal offenses and to those who have not been sentenced with an “aggravating role adjustment” for directing or overseeing federal criminal activity. It also directs the U.S. Comptroller General to include, as part of broader research on cannabis, the “uses of marijuana and its byproducts for purposes relating to the health, including the mental health, of veterans.”

Chris Lindsey, legislative analyst for the Marijuana Policy Project (MPP), said other provisions in the bill would be “very good” for the cannabis business community. The descheduling of cannabis would allow the industry to access banking, for example, and would provide tax relief for businesses who have long bore the burden of 280E.

“It’s likely that more states would adopt regulatory programs if there were a clear path provided to them by the federal government,” Lindsey said. “Clearly, it’s not stopped the states that have wanted to go that way already, but no doubt, having a system in place that states can recognize would be very helpful, from my own perspective as an advocate.”

Cannabis Dispensary Editor Cassie Neiden, Digital Editor Eric Sandy and Cannabis Business Times Editor Michelle Simakis contributed to this report.