There is a significant increase in demand for all cannabinoid products across the board—including CBD, THC, CBG and THCV—from recreational users, consumer packaged goods and pharmaceutical companies. And the next great race is on for the hottest arrival to scientific cannabis therapeutics: rare cannabinoids.

Research shows rare cannabinoids are poised to be the future of cannabis investing, providing better health benefits in addition to impacting the pharmaceutical, CPG, nutraceuticals, cosmetics and pet care markets significantly. According to recent reports, the biosynthesis of rare cannabinoids will be a $25 billion market by 2025 and $40 billion by 2040.

The companies that will revolutionize this market are ones with the highest quality and lowest prices, which means that biosynthetic cannabinoid companies will be the leaders in investment and capturing market share. We will also see a major consolidation in this market amongst the grow, harvest and extraction companies, increasing efficiencies and driving down costs.

What are rare cannabinoids and why should we care?

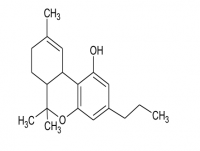

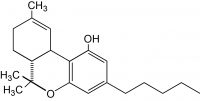

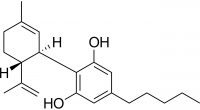

Rare cannabinoids such as CBG, CBN, THCV, THCA and others have significantly better and more specific health benefits than just CBD on its own. Biotech companies like ours, Biomedican, which has a patent-pending biosynthesis platform, can produce pharmaceutical grade, non-GMO, bioidentical, synthetic cannabinoids with 0.0% THC at 70-90% less cost. Producing 0.0% THC means that rare cannabinoids can be added into nutraceuticals, CPG and cosmetics/lotions with zero changes in current cannabis regulations. Also, we produce the same exact product every time (not possible through plants), which is extremely important for pharmaceutical companies conducting clinical trials.

Why are rare cannabinoids important?

The human body contains different cannabinoid receptors that help regulate critical processes, including learning, memory, neuronal development, appetite, digestion, inflammation, overall mood, sleep, metabolism and pain perception. This considerable involvement of cannabinoid receptors, critical to many physiological systems, underscores their potential as pharmaceutical targets.

Pharmacological research has uncovered several medical uses for cannabinoids, which bind to cannabinoid receptors. They’ve been shown to help with pathological conditions such as pediatric epilepsies, glaucoma, neuropathic pain, schizophrenia and have anti-tumor effects as well as promote the suppression of chemotherapy-induced nausea. This ongoing research is becoming more prevalent and has the potential to uncover therapeutic uses for an array of cannabinoids.

In addition to the medical field, other prominent sectors have adopted the use of cannabinoids. There is an increasing demand for cannabinoids in inhalables, the food industry and in hygienic and cosmetic products. Veterinary uses for cannabinoids are also coming to light. The use of naturally occurring cannabinoids reduces the need for synthetic alternatives that may produce harmful off-target effects.

So how does this affect the investing market?

Where there is demand, significant and growth investments follow. All the major players from nutraceuticals, CPG, cosmetics and pet care companies are driving the demand for rare cannabinoids. We are seeing a major investment shift from commodity-based prices for cannabis and CBD to the new biosynthesis technology which offers significantly better health benefits and higher profit margins. Those unique qualities of rare cannabinoids open an enormous opportunity to create new drugs and food supplements for treating various medical conditions and improving the quality of life. This creates a massive global opportunity for all companies in these categories differentiating their products from competitors.

There will be big winners and losers in these markets, but at the end of the day, the highest quality and lowest cost producers will capture most of these markets. Biomedican has the highest quality, highest yields and lowest cost of production in the industry. Which we believe will make us the clear leader in the biosynthesis rare cannabinoid markets.

Which rare cannabinoid to invest in first?

Early reports indicate THCV (not to be confused with THC) could contain a variety of health benefits: it may help with appetite suppression/weight loss, possibly treat diabetes as well the potential to reduce tremors and seizures caused by conditions like multiple sclerosis, Parkinson’s disease and ALS.

There has been an explosion of interest in THCV due to its potential health benefits. We are seeing major players in the nutraceutical, health food and pharmaceutical industries clamoring to add THCV to their product lines. Companies can now produce THCV through biosynthesis, creating a pharmaceutical-grade, organic, bioidentical compound at 70-90% less than wholesale prices. This is exactly what the largest players in the market want: a pharmaceutical-grade, consistent product at significantly less cost. The current prices and quality have limited THCV production, but new breakthroughs in biosynthesis have solved those issues, so we expect a tsunami of orders for THCV in 2021.